Understand the fundamentals of 1031 exchanges and how they can unlock opportunities for property owners like you.

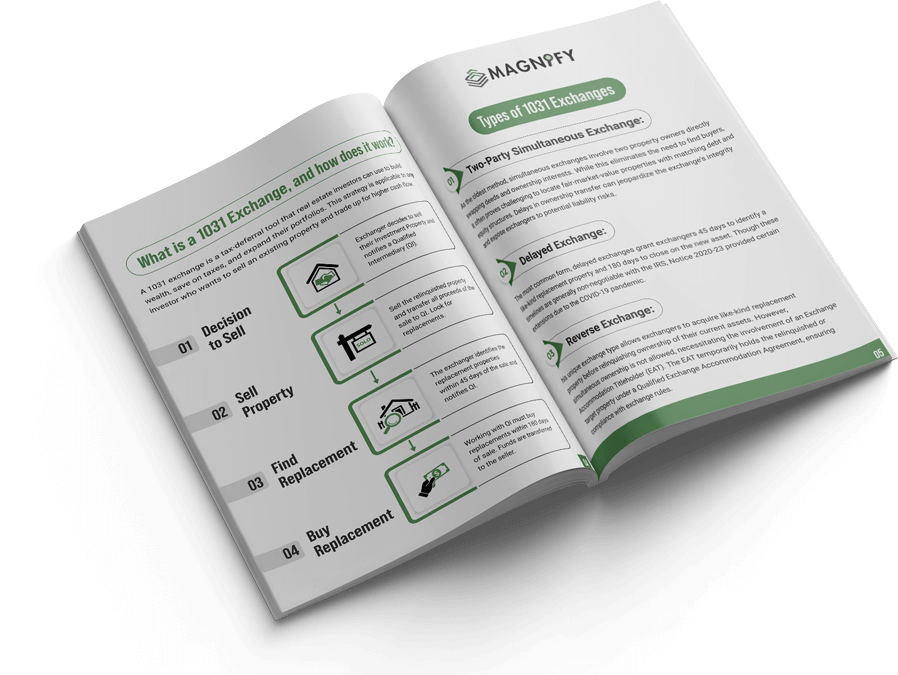

Learn the four essential steps involved in executing a successful 1031 exchange and maximize your benefits.

Explore inspiring case studies of investors who have utilized 1031 exchanges to build lucrative portfolios and enhance their financial standing.

Discover the numerous advantages of implementing 1031 exchanges

Maggy: Hello, this is Maggy, and I am Magnify's AI-powered chat bot. How can I help you today?